CoreWeave stock jumped over 10% in premarket trading Tuesday following the announcement of a massive $14.2 billion artificial intelligence computing contract with Meta Platforms. This landmark deal represents one of the largest AI infrastructure agreements in recent history, highlighting the explosive demand for GPU computing power in today’s AI-driven market.

Key Points

- CoreWeave stock climbed 10% in premarket trading on September 30, 2025

- $14.2 billion Meta AI deal secured for cloud infrastructure computing services

- $6.5 billion OpenAI expansion announced just five days earlier on September 25

- Evercore ISI initiated coverage with “outperform” rating and $175 price target

- 200%+ stock gains since March 2025 IPO debut at $40 per share

Table of Contents

CoreWeave Meta Deal Drives Stock Rally

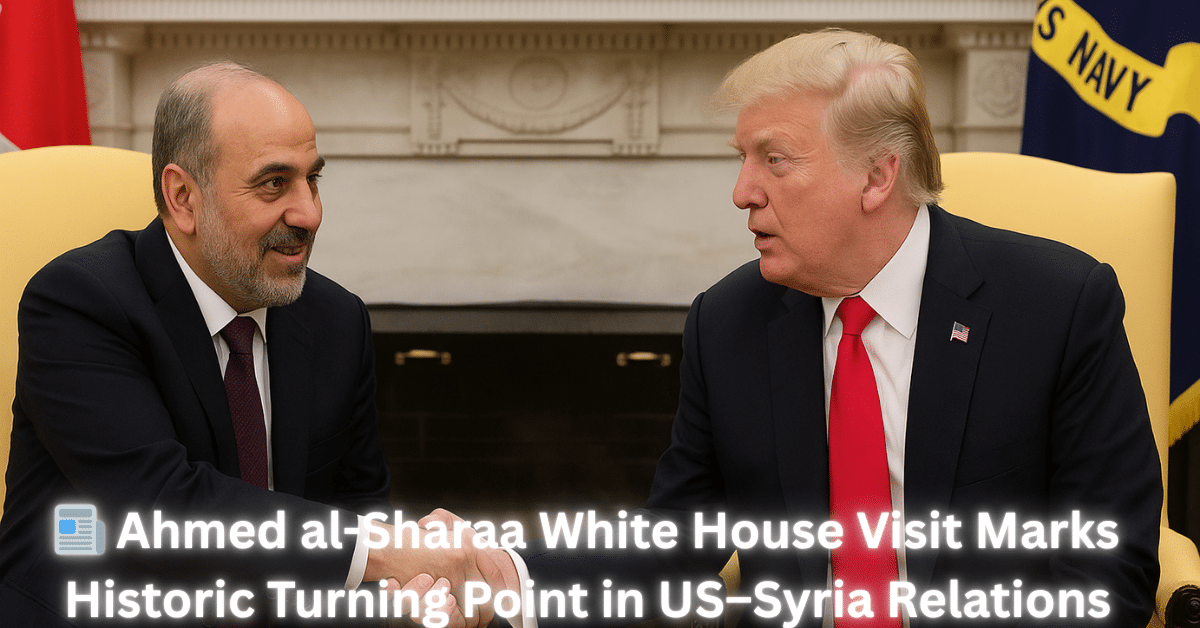

The CoreWeave Meta deal announcement sent shockwaves through Wall Street, with investors recognizing the strategic importance of this partnership for the AI cloud infrastructure sector. Meta Platforms will rely on CoreWeave’s specialized GPU computing infrastructure to power its artificial intelligence initiatives, marking a significant validation of CoreWeave’s technology platform.

This follows CoreWeave’s recent expansion of its OpenAI partnership by an additional $6.5 billion, bringing their total contracted revenue with OpenAI to $22.4 billion. The back-to-back announcements demonstrate the company’s ability to secure long-term, high-value contracts with leading AI companies.

AI Infrastructure Stock Performance

AI infrastructure stocks have emerged as major beneficiaries of the current artificial intelligence boom, with CoreWeave leading the charge among specialized cloud providers. The company’s stock has delivered exceptional returns, gaining over 200% since its March 2025 initial public offering.

GPU computing stocks across the sector have attracted significant investor attention as demand for specialized AI hardware continues to outpace supply. CoreWeave’s unique positioning as an NVIDIA-backed cloud provider gives it competitive advantages in securing GPU capacity for its customers, especially as the industry sees major developments like the Snapdragon 8 Elite Gen 5’s revolutionary AI processing capabilities driving mobile AI adoption.

Financial Performance and Analyst Outlook

CoreWeave Earnings Strength

CoreWeave earnings have shown remarkable growth trajectory, with Q2 2025 revenue reaching $1.213 billion, representing a 206.7% year-over-year increase. The company maintains healthy profitability with 62% adjusted EBITDA margins and has built an impressive $30.1 billion revenue backlog providing multi-year visibility.

Management projects $8 billion in full-year 2025 revenue, up dramatically from $1.9 billion in 2024. This growth is driven by increasing demand for AI computing power and CoreWeave’s expanding customer base beyond its anchor clients.

Wall Street Upgrades Signal Confidence

Evercore ISI initiated coverage on CoreWeave with an “outperform” rating and $175 price target, suggesting 40% upside potential from current trading levels. The analyst cited strong AI infrastructure demand that “far outpaces supply” and expects lower interest rates to reduce operational costs.

Loop Capital has also maintained bullish sentiment with a “Buy” rating and $165 price target, highlighting expected growth in CoreWeave’s profitability. Multiple analyst upgrades suggest institutional confidence in the company’s long-term prospects.

Strategic Partnerships Drive Growth

CoreWeave benefits from a unique strategic partnership with NVIDIA, which has invested in the company and committed to a $6.3 billion agreement to purchase unused GPU capacity through April 2032. This “NVIDIA backstop” significantly reduces downside risk and provides guaranteed utilization of infrastructure investments, particularly as NVIDIA continues expanding its ecosystem through partnerships like the recent $5 billion investment deal with Intel.

Microsoft remains CoreWeave’s largest customer, contributing 62% of revenue through a multi-year $10 billion commitment. The diversified client base now includes OpenAI, Meta, and other major cloud providers seeking specialized AI computing resources.

Market Position and Future Outlook

CoreWeave IPO Performance

CoreWeave IPO performance has exceeded expectations since the company went public in March 2025 at $40 per share. The stock currently trades around $120-125 range, delivering substantial returns for early investors despite some volatility during the summer months.

The company raised significant capital through its IPO to fund expansion plans, including increasing active power capacity to 900 megawatts by the end of 2025. This infrastructure buildout positions CoreWeave to capture growing demand for AI computing services.

Conclusion

CoreWeave stock continues to demonstrate strong momentum as the company secures landmark partnerships with AI industry leaders, positioning itself as a critical infrastructure provider in the rapidly expanding artificial intelligence ecosystem.

FAQs

Q: What caused CoreWeave stock to surge today?

A: CoreWeave stock jumped over 10% following the announcement of a $14.2 billion contract with Meta Platforms for AI cloud infrastructure services, marking one of the largest deals in the sector.

Q: How much has CoreWeave stock gained since its IPO?

A: CoreWeave stock has gained over 200% since its March 2025 IPO debut at $40 per share, currently trading around $120-125 range.

Q: What is CoreWeave’s revenue growth rate?

Q: What is CoreWeave’s revenue growth rate?

A: CoreWeave reported 206.7% year-over-year revenue growth in Q2 2025, with quarterly revenue reaching $1.213 billion and projecting $8 billion for full-year 2025.

Q: Who are CoreWeave’s major customers?

A: CoreWeave’s major customers include Microsoft (62% of revenue), OpenAI ($22.4 billion total contract value), and now Meta Platforms ($14.2 billion new deal).

November 20, 2025